by admin | Jan 1, 2024 | IRS

Introduction: As we enter the tax year 2024, the IRS has unveiled a new set of tax brackets, bringing changes that will significantly impact your financial situation in Texas. These alterations have been introduced to address concerns related to “bracket creep” and...

by admin | Dec 18, 2023 | IRS

It can be intimidating and unpleasant to deal with the IRS, particularly if you’re trying to settle a sizable tax bill on your own. Many taxpayers are caught up in a maze of bureaucracy and difficult-to-understand processes. This post will highlight the main...

by admin | Dec 11, 2023 | IRS

The Internal Revenue Service (IRS) has recently unveiled some alarming statistics that have far-reaching implications for both tax compliance and government revenue. In 2021, the IRS estimated a colossal $688 billion gap between the taxes owed and the actual IRS debt...

by admin | Sep 11, 2023 | IRS

Many workers are now in a completely different scenario as the transition from traditional employment to self-employment and business ownership keeps moving forward. As more people turn to gig labor, freelancing, and self-employment, the IRS has taken note, and its...

by admin | Sep 1, 2023 | IRS

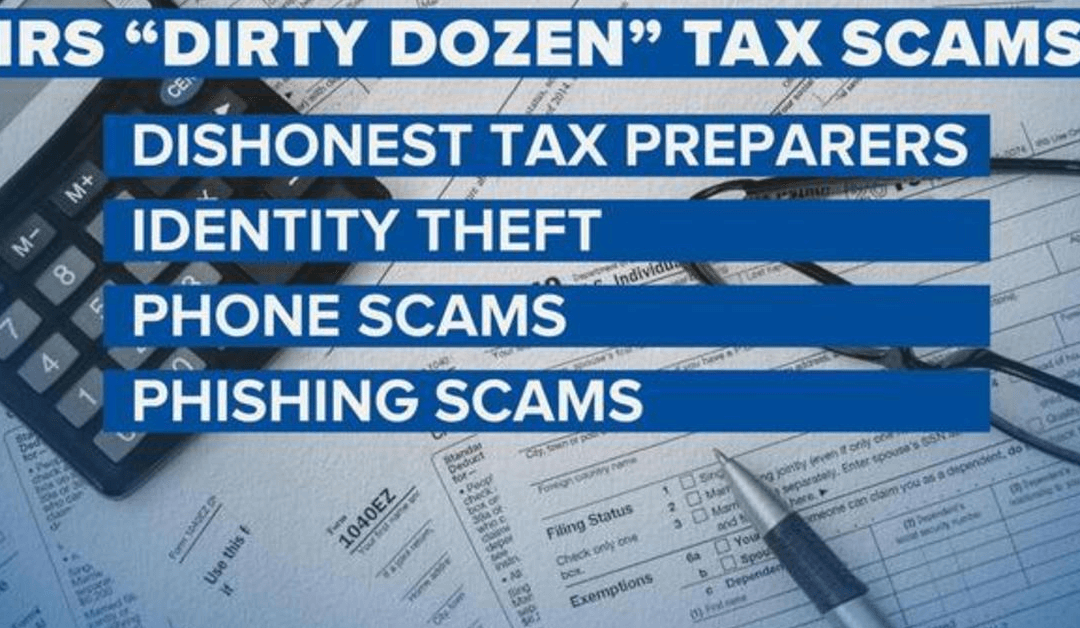

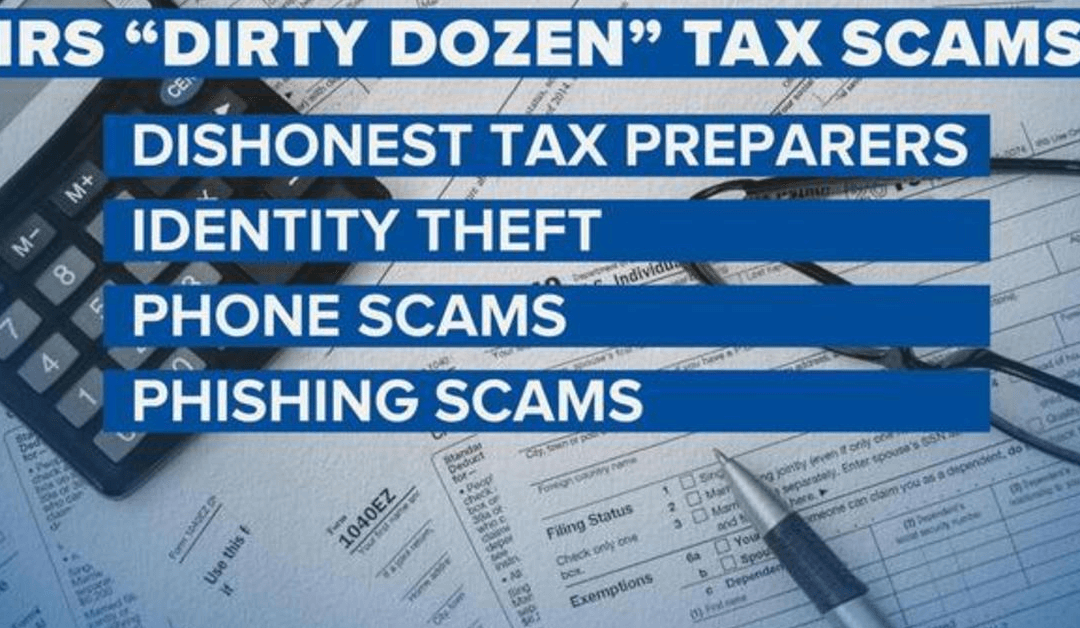

The time of year when taxes need to be filed causes worry for almost everyone. You’re constantly dealing with more stress and uncertainty, and you’re never sure if you’ll have to send the IRS a check. Additionally, you may put yourself in danger...

by admin | Aug 7, 2023 | IRS

According to tax professionals, there are some circumstances in which you may be able to have IRS tax penalty notice fees waived. Otherwise compliant taxpayers can receive relief under the less well-known first-time penalty abatement. “It’s like a get out...